Market Perspectives – May 2017

Capital Markets

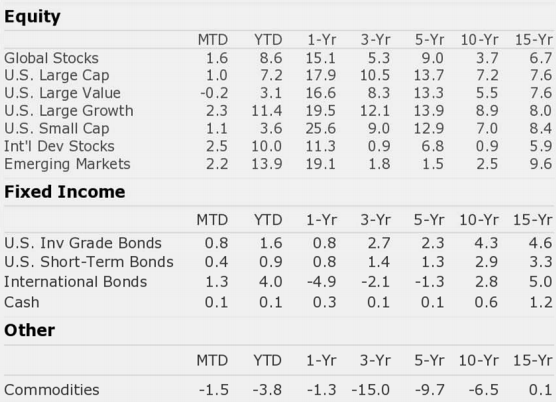

April was a relatively uneventful month as markets inched higher. For the month, growth stocks beat value stocks, large cap stocks beat small stocks, and international stocks beat U.S. stocks, continuing the trend thus far in 2017. Bonds posted slightly positive returns during April while commodities continued their slide for the year.

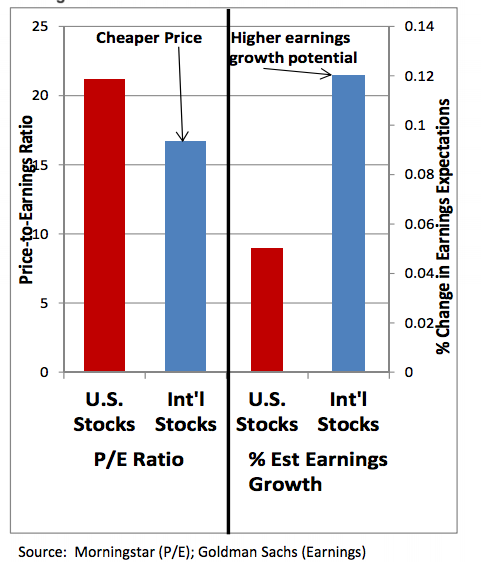

On April 23, 2017, France held its national election. Five candidates squared off, with four of the candidates garnering more than 18% of the popular vote. Because no one reached a majority in the vote, the top two contenders advanced to the final round, which was held on May 7th. Immediately following the first round of voting markets rallied strongly. Most interpreted the rally to be driven by the emergence of establishment-backed Emmanuel Macron who was running on a pro-business, pro-immigration, pro-globalization, and pro-European Union platform. Mr. Macron ultimately won the French election in round two. The recent market activity abroad further strengthens our view that international equities have room to run relative to U.S. equities.

Economic data was mixed in April. The dispersion between “soft” data and “hard” data remains intact. Soft data from business and consumer surveys suggest high optimism, yet measures of actual economic growth have largely been consistent with 2016 growth.

Following the Fed rate hike in March, the FOMC met in early May. While the Fed held rates constant as expected in May, they signaled a rate hike in June, staying on track for their projected three hikes in 2017. A relatively strong jobs report on May 5th reduced the unemployment rates to 4.4% and gives further cover for the Fed to continue its rate hike path. Perhaps more importantly, actions taken to unwind the Fed balance sheet could have meaningful impacts on the market in the coming months.

The Establishment Strikes Back in France

Emmanuel Macron has become the next President of France. Mr. Macron is a former investment banker who has never held political office and in many ways represents the “establishment” in France which includes favoring the EU, immigration, globalization, and trade. Marine Le Pen, the populist candidate who represents the National Front party, lost handily to Mr. Macron. After three surprising votes that favored populist movements in the U.K., U.S., and Italy in 2016, this year has witnessed a reversal in trend with establishment candidates winning in Holland and France. A few thoughts:

- Despite the latest defeats to populist politicians, it’s hard to ignore the growing movements across the western world.

- Despite each country having different politics, there are similar characteristics in populist movements from country-to-country.

- Many have blamed free trade and globalization for these movements. There may be some truth to this view but there may be other causes.

- Technology advancements may be the most potent cause of these movements. Technology advancements have displaced a portion of the workforce and kept overall wage growth low in recent years while generating record high profits for many companies and investors.

- It seems possible that this trend will only intensify as machine learning (aka robotics) becomes capable of doing many jobs.

- It’s very hard to tell at this juncture whether the economy will be able to generate enough jobs to replace the displaced jobs from robotics.

- These trends will likely to lead to greater discontent and uncertainty in western societies.

- Some would argue that these trends are good reason to lower risk in their investment portfolios. We don’t necessarily think so.

- We believe the best way to help mitigate the risk of technology advancements driving high unemployment is to own stocks, as companies should benefit from lower input costs and higher profits.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“The single greatest edge an investor can have is a long-term orientation.”