Market Perspectives January 2025

Capital Markets

By: Wade Austin

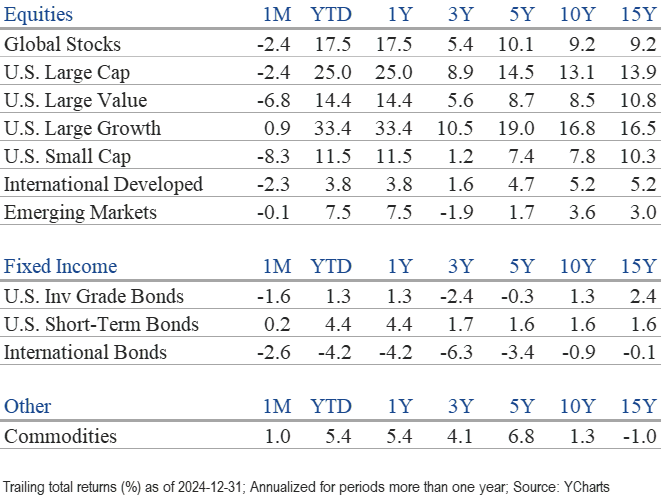

December proved challenging for both equity and fixed income markets, as investors grappled with lingering concerns over inflation, the Federal Reserve’s more tempered rate-cut outlook, and geopolitical tensions. Despite these late headwinds, most investors were pleased with the performance of markets in 2024. Here’s a breakdown of the key themes:

Equity Markets:

- The S&P 500 experienced a disappointing decline in the year’s final weeks, ending the month down 2.4%, which moderated its Q4 return to 2.4%.

- Small-caps, large-cap value, and international stocks faced even stronger headwinds in December, falling 8.3%, 6.8%, and 2.3%, respectively. The Dow Jones Industrial Average benefited from the broadening of the rally in the fall but dropped 10 consecutive days during a mid-month stretch, recording its longest losing streak in 50 years. Fed rate concerns, inflation jitters, and turbulence among healthcare stocks led to its underperformance.

- While a Santa Claus Rally failed to deliver this December, the S&P 500 still gifted investors a 25% total return for the year. These substantial gains were driven mainly on the back of broadening earnings growth, AI-related tailwinds, and the continued appetite for equities among investors. On the heels of 2023’s 26% total return, the U.S. large-cap index posted its best back-to-back yearly performance since 1998.

- Nearly identical to 2023’s results, the 10 largest stocks by market cap weight in 2024 had an enormously outsized influence on S&P 500 performance, contributing 68.1% of its 23.3% price return. More notably, excluding the Mag 7 stocks, the “other 493” rose just 9.8% in 2024.

- Regardless of a pullback that turned eight of the 11 large-cap sectors negative for December, all but one posted gains for the year. Communication Services (+40.2%), Technology (+36.6%), and Financials (+30.5%) led the charge. Materials (-0.04%) was the laggard, followed by Healthcare (+2.6%) and Energy (+5.7%).

Bond Markets:

- The bond market also experienced notable volatility in December. The yield on the 10-year U.S. Treasury note rose to 4.58% by year-end, reflecting ongoing uncertainty about the future path of interest rates. The Federal Reserve initiated rate cuts last September; but at their FOMC press conference on Dec. 18, they reduced the projected number of cuts for 2025 from four to two and raised their inflation forecast.

- With the Fed cutting short-term rates three times and 100 bps since Sept. 18, some investors assumed 10-year yields would follow suit. However, longer-term rates reflect the economic and inflationary outlook. Concerns over the debt, stubborn inflation, and the threat of tariffs drove 10-year yields 79 bps higher.

- Amid this backdrop, the broad U.S. Bloomberg Aggregate Index struggled in December (-2.2%) and Q4 (-5.1%) but maintained a full-year gain of 1.3%.

- Municipal bonds also declined for the month and quarter but outperformed Treasuries. Less interest-rate-sensitive fixed income sectors fared best but also declined in December. High-yield corporates returned 8.2% in 2024 and outperformed all fixed income sectors, as defaults remained low given the resilient U.S. economy.

Key Takeaways:

- The average bull market lasts 5.5 years. The third year of a bull market historically is choppy and experiences more muted gains, and 25% don’t reach the fourth year. Markets typically need time to digest the first two years’ large gains. The one dramatic exception was the late 1990s, when the S&P 500 posted total return gains between 20% and 40% for five consecutive years (1995-1999). Of course, the frenzy led to the dot-com bubble and a lost decade for U.S. stocks.

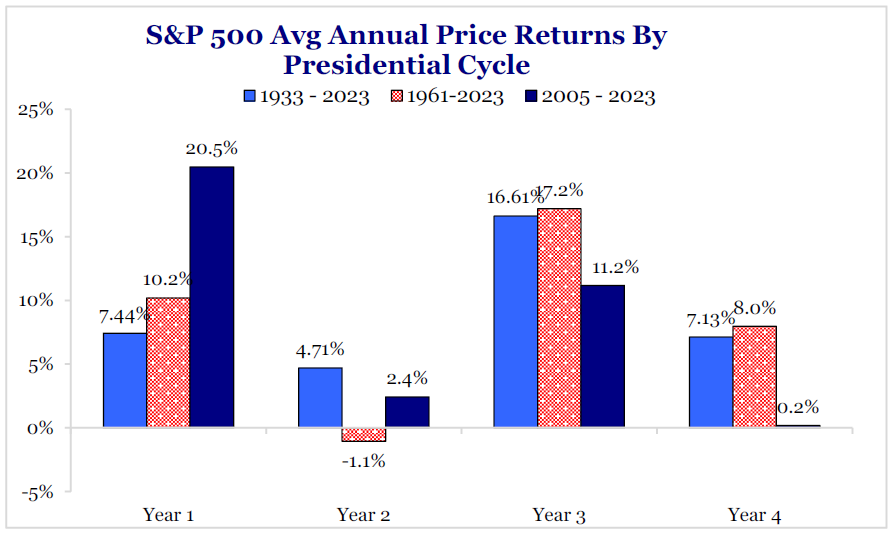

- The first year of a President’s term has been good for U.S. stocks. The key has been avoiding a recession, such as in 1969, 1981, and 2001. Our Chart of the Month reveals that since 1961, Year 1 returns for the S&P 500 have averaged 10.2%. More recently, the Year 1 returns have been even stronger: Obama ’09 (+23.5%), Obama ’13 (+29.6%), Trump ’17 (19.4%), and Biden ’21 (26.9%).

- According to John Silvia, our Director of Economics, the encouraging news entering 2025 is that the chances of a recession are quite low. Given current strength in corporate earnings, expanding profit margins, healthy labor markets, calm credit conditions, and the incoming administration’s pro-business policies, the multiple expansion that large-cap stocks enjoyed during 2024 is, in hindsight, not surprising.

- One challenge for investors in 2025 is that stocks begin the year richly valued. The S&P 500’s forward P/E of 21.5x is 35% above its 20-year average. Valuations could still go higher and are a notoriously poor timing tool. However, they have been predictive of longer-term forward returns.

- Market concentration is another crucial consideration for the path of U.S. stocks going forward. The top 10 stocks, as a percentage weighting of the S&P 500, previously reached a record level of 26.7% in the late 1990s but steadily declined over the next 15 years. Starting 2025, the Mag 7 plus Broadcom, Berkshire Hathaway, and J.P. Morgan comprise an all-time record 38.7% of the index. Given Mag 7’s massive influence, the direction of the index in the near term appears dependent on the continued realization of AI optimism in the form of monetization of investments being made and outsized productivity gains for themselves and their customers.

- Corporate bonds also trade at premium valuations, as the spread between their bond’s yield and Treasury yields of similar maturities hovers near record lows. Negative economic surprises make them vulnerable to swift pullbacks. Treasurys also don’t seem attractive with yields on the rise. Uncertainty related to the incoming administration’s new policies increases economic risk, which, in turn, is pressing yields higher. The silver lining is that elevated yields across all fixed income sectors provide attractive income relative to their 10-year range.

- For most investors, diversification calibrated to your appropriate risk tolerance is the best approach to navigating periods of lofty valuations. No one rings a bell at the top or the bottom. Last year was a great example. After a stellar 2023, the Wall Street consensus price target for year-end 2024 was 4,861. Instead, the S&P 500 delivered 57 all-time highs last year and closed at 5,882, more than 1,000 points higher! Clearly, it wasn’t a year to be caught sitting on the sidelines. Diversification allows investors to reduce volatility, achieve attractive risk-adjusted returns, and, most importantly, increase the odds of sticking with their portfolio.

Insights by John Silvia, Director of Economics

Today’s economic fundamentals remain positive. Tomorrow’s economic policies remain uncertain.

- For Q4 2024, estimates on the pace of economic growth, from the Atlanta Fed GDPNow estimate, are at 2.4% (Jan. 3 estimate). As measured by the S&P 500, equity prices were up 3.3% over the last three months and 25% over a year ago. For interest rates, the 10-year rate is up over three months ago, and the relative value of the U.S. dollar is up 6.27%.

- Optimism about the economy has improved, as signaled by the higher consumer sentiment from December’s University of Michigan survey. New business orders, as measured by the ISM purchasing managers’ survey, were above breakeven, as reported last week for the month of December. New orders are a leading indicator of the economy.

- Nonfarm employment rose 227,000 in November (latest report), and total job gains in the prior two months were revised 56,000 higher. Private payrolls rose 194,000 in November. Over the last three months, job gains averaged 173,000.

- Job gains were noticeable in healthcare and leisure & hospitality. The unemployment rate is 4.2%, compared to 3.7% a year ago. This signals reduced pressure in the labor market, although wages grew 4% – a pace suggesting upward pressure on labor costs.

- Building permits, a third leading economic indicator, were up in November for both single-family and multifamily units over three months ago.

- Policy uncertainty begins with inflation. The Fed’s benchmark inflation rate remains above target and has been steadily above target over the last three months.

- The persistence of core PCE inflation at 2.8% (November) signals that the Fed is unlikely to continue easing in January. As of November, the Federal Reserve Bank of Dallas trimmed mean remains at 2.7%. Declines in this trimmed mean have flattened out and suggest little progress towards the Fed’s 2% target.

- Above-trend economic growth and above-target inflation provide the basis for our expectation that benchmark 2- and 10-year Treasury rates will remain above 4% for the next three months. Therefore, we expect the 30-year fixed-rate mortgage rate to remain in the 6% plus range for 2025.

- The housing outlook for single-family housing remains positive. Real household incomes are up 2.7% over a year ago. As measured by the University of Michigan survey, consumer sentiment has improved. Household new wealth has risen to a record $170 trillion as of Q3 2024. The challenge is that mortgage rates remain a barrier to new buyers, and housing affordability remains limited.

- On balance, we anticipate an improvement in housing starts in 2025 to 1.4 million, compared to 1.36 million in 2024. Job and income gains and the improvement in consumer sentiment will support a modest improvement in housing starts.

- Expectations for growth and interest rates in the U.S. favor a stronger U.S. dollar. Over the last three months, it has appreciated relative to the Euro, British pound, Canadian dollar, and Mexican peso.

- Profits have been a big positive surprise for investors and have supported equity valuations. Pre-tax corporate profits bottomed out in Q4 2022 and are up 8.8% year-over-year as of Q3 2024 (Bureau of Economic Analysis estimates). Strength in real final sales and improved productivity, which has lowered employment costs, have boosted profits above market expectations and, thereby, equity valuations.

- Policy uncertainties, however, will dominate in 2025. What will the gap between expectations, discounted in equity values, and the reality of policy deliverables be? Policy movements on deregulation, immigration, and tariffs remain ahead for investors into 2025.

- Expectations for significant deregulation have boosted equity valuations for regional banks, investment banks, crypto exchanges, and Bitcoin. For investors, there is the issue of valuation. How much have investors priced in deregulation? There is also the risk that diminished oversight will lead to capital losses and significant legal risk for failing to follow prudent guidelines.

- How much will policy reduce illegal immigration, and what impact will such a policy movement have on the availability and cost of labor? The challenge in the labor markets is whether excessive curtailment of legal immigration will disappoint growth expectations and whether labor shortages will appear in the retail, hospitality, and construction sectors.

- In the short run, tariffs will raise the price of goods. Over time, will tariffs lead to a renegotiation of barriers to U.S. exports and to reshoring production in the U.S.?

- On the global front, the initial disappointing China reopening has led to continued pessimism. Incidents of financial and commercial real estate weakness continue to moderate the economic outlook for China.

- Expectations for economic growth in Europe and Japan continue to be below 1% for the year ahead. Consensus estimates for Canadian and U.K. growth have improved to 1% for 2025.

- The central theme in our outlook remains: U.S. financial markets continue to adjust to the reality of better-than-trend economic growth, higher-for-longer interest rates, and recently improved profit/productivity gains.

- In the longer term, the imbalance between Federal spending and Fed policy flags problems for investors, as both policies will put upward pressure on real interest rates. At the end of December, the 2-year and 10-year Treasury rates had risen to 4.25% and 4.58%, respectively.

Quote of the Month

“Keep your eye on one thing and one thing only: how much government is spending. Because that’s the true tax. If you’re not paying for it in the form of explicit taxes, you’re paying for it in the form of inflation or borrowing.”

— Milton Friedman, American Economist and Nobel Prize Winner

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change, and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc., as of 3/31/2022. Asset class performance represented by annual total returns for the following indexes: S&P 500® Index (US Lg Cap), Russell 2000® Index (US Sm Cap), MSCI EAFE® Net of Taxes (Int’l Dev), MSCI Emerging Markets IndexSM (EM), MSCI US REIT Index (REITs), S&P GSCI® (Comm.), Bloomberg Barclays U.S. Treasury Inflation-Linked Bond Index (TIPS), Bloomberg Barclays U.S. Aggregate Bond Index (Core US Bonds), Bloomberg Barclays U.S. High Yield Bond Index (High Yield Bonds), Bloomberg Barclays Global Aggregate Ex-USD TR Index (Int’l Dev Bonds), Bloomberg Barclays Emerging Markets USD Bond TR Index (EM Bonds), FTSE U.S. 3-Month T-Bill Index (T-Bills). Past results are not an indication or guarantee of future performance. Returns assume reinvestment of dividends, interest, and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Chart of the Month: Strategas