Holiday Discounts and Market Premiums

Market Perspectives – December 2017

December 7, 2017

Market Perspectives – January 2018

January 8, 2018

By: Abby Bennett, CFP®

It’s the most wonderful time of the year, and while I haven’t toasted too many marshmallows lately, I certainly have done my fair share of online shopping. We are in the season of sales and retailers have spared no expense ensuring that we all are aware of every discount being offered. Consequently, I spend evenings comparing prices before clicking the big, bold “Place Order” button. Feeling like you got a great deal is so satisfying. An article recently published in MarketWatch described it well – “[retailers] turn bargain hunting into a game.” I am a willing player.

A steep discount can be hard to ignore, especially when you are inundated with holiday bargains!

Wouldn’t you want to purchase something when it goes on sale, if given a choice? If I want a 60” 4K Ultra HD TV to watch the Hokies play, and it’s marked down 50% on Black Friday, I’m going to make that purchase before the price goes back up. Why spend $700 when I could spend $350 for the same thing?

Given the excitement that a “super sale” induces in the retail world, shouldn’t we expect a similar response to a substantial price drop in the stock market? If Apple’s stock price goes “on sale” by 50%, and you can spend $350 instead of $700 for the same number of shares, wouldn’t you rush to buy it? Or, would you wait until the price doubled to buy?

Many investors find themselves closely following market headlines as stock prices continue to climb, anxious to act. There are two common themes we hear often:

- Fear of missing out on “ever-rising” values in the stock market and eagerness to participate. It seems that investing is the only segment of our lives in which a substantial increase in price creates a buying frenzy (beware of the FOMO).

- Fear of an imminent collapse or recession and eagerness to sell out before any account balances take a hit. The temptation to sell and wait for a lower entry point can grow strong, but doing this correctly requires two correct decisions – when to get out and when to get back in.

Perhaps you’ve considered both sets of concerns and have asked yourself this question: what should I do? Our suggestion to our clients: develop a long-term allocation, built to sustain the highs and lows, and then stay the course.

Daily record highs can be hard to ignore, especially when your hard-earned savings is on the line, but consider the following:

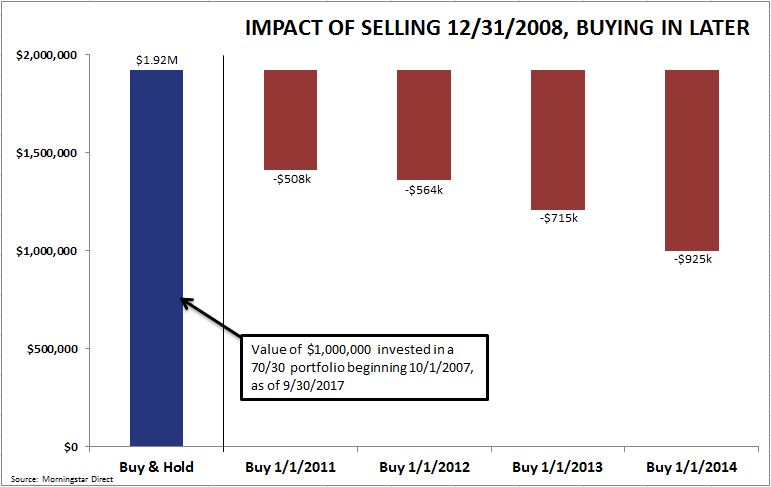

If you had invested $1,000,000 into a portfolio consisting of 70% Stocks, 30% Bonds on 10/1/2007, you would have likely spent the next 18 months being pretty uncomfortable. However, had you powered through the discomfort, rebalanced annually, and kept to your investment plan, your portfolio would be valued just under $2,000,000 ten years later. Said differently, you would have almost doubled your money in 10 years (~92% cumulative return), despite the Great Recession.*

Comparatively, if you panicked and sold everything at the end of 2008, your outcome would have been drastically different. Depending on when you bought back into the market, the growth of your portfolio over those same ten years could have ranged from slightly negative to less than half of the growth demonstrated in the “Buy and Hold” scenario described above.

In this example, the result of two emotionally-propelled actions (selling near the bottom, and then buying back in later) could have left over $900,000 on the table.*

Hindsight is 20/20, and no one in 2007 could have told you what the markets would do over the next ten years. While this example is fairly basic, it demonstrates that ignoring the noise and staying the course can often be the best decision.

As you are doing your holiday shopping, I encourage you to do your research and take advantage of a good sale. You may miss the lowest price, but a few dollars over such a short time horizon (presumably a few weeks…or days, if you are like me and shop at the last minute) is fairly negligible. In contrast, as you continue to see headlines of “market mania” or “imminent doom” in the investment world, ignore the noise and stay the course. A disciplined plan, built to endure the highest highs and the lowest lows, is your best bet as you chart your long-term financial course.

Abby Bennett, CFP® is a financial planner in Charlotte, NC. She provides financial advice to families and business owners, and specializes in financial planning for engineers and tech professionals. Click here to learn more about Abby.

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns.

*Chart data sourced by Morningstar Direct and Carolinas Investment Consulting. Sample uses a portfolio made up of 70% S&P 500, 30% Barclay’s Aggregate, and assumes the portfolio is rebalanced annually.