By: Wade Austin

The four most dangerous words in investing are said to be, “This time is different.” Yet today, “unprecedented” is clearly more factual than hyperbole.

With so much uncertainty surrounding the COVID-19 threat and possible shelter-in-place mandates, we want to share with you the steps we are taking to help slow the potential infection rate in our community while continuing to care for our clients.

By: Wade Austin

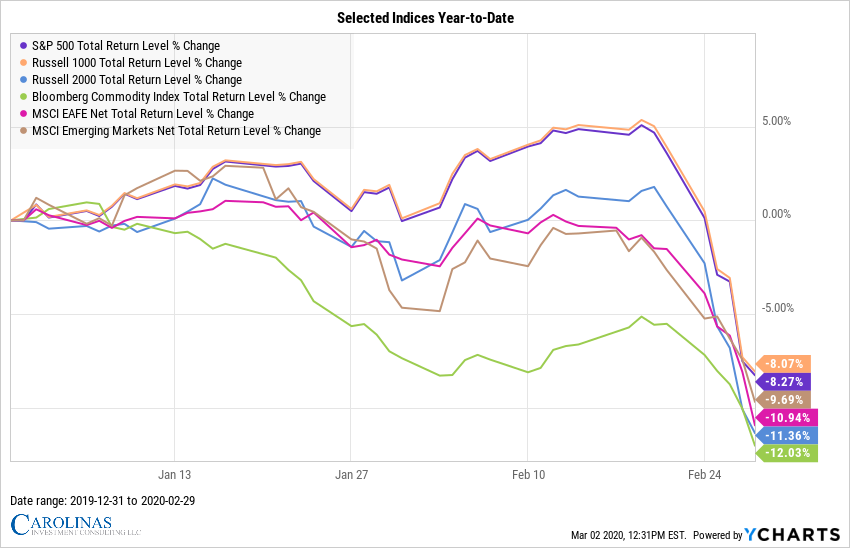

After ending January with a minor 3% pullback upon the emergence of the coronavirus in China, the S&P 500 surged 5% to an all-time high of 3386 on February 19th, responding to better than expected corporate earnings and early signs of a global manufacturing recovery.

By: Robert R. Shaw

The COVID-19 coronavirus outbreak is driving fear and market volatility in China and throughout the world.

By: Wade Austin

U.S equity markets began the new decade seamlessly from 2019.

By: John E. Silvia

A Question on Prosperity

Several years ago, a TV commercial ended with the comment that “luck is for rabbits.” So it is for investing.

By: Wade Austin

It scarcely seemed possible one year ago – shortly after the S&P 500 dropped 9% between the Fed’s last meeting of the year and Christmas Eve –

By: Robert R. Shaw

Summaries of manager performance and simulations of hypothetical portfolios commonly include trailing time periods up to ten years.

By: Wade Austin

Yikes!