Market Perspectives – January 2018

Capital Markets – A Look Back at 2017

2017 will go down in the history books. It marks the first calendar year on record in which the stock market posted positive monthly returns in all 12 months (the market is currently on a record 14 month streak). The year will also be remembered as the lowest volatility year in the history of the stock market (1995 and 1964 are the only two debatably close). Below are the major themes from the year:

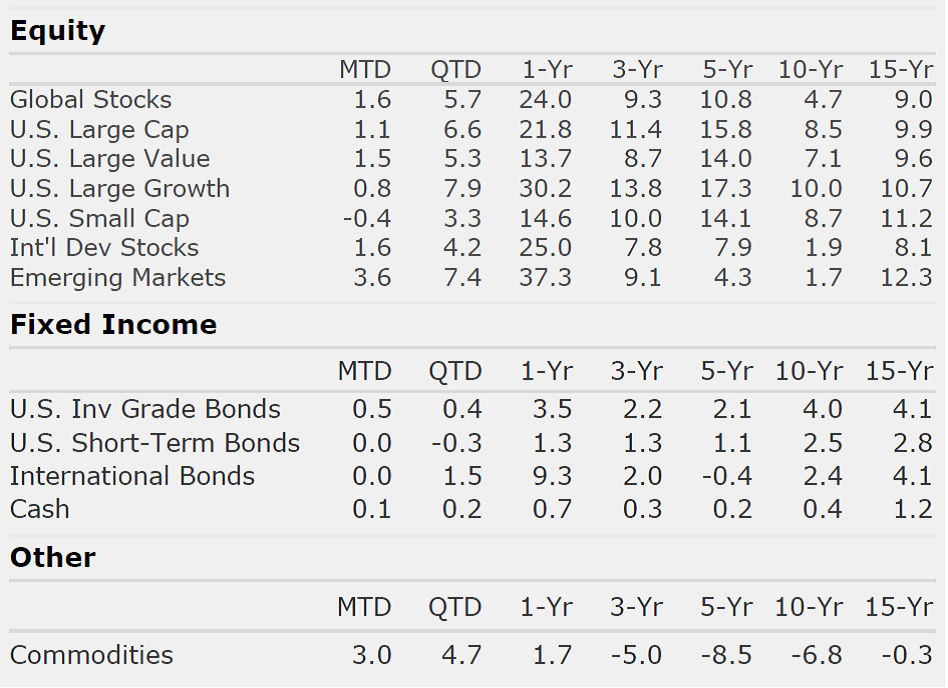

- Strong Market Returns: All three major U.S. indexes (Dow, Nasdaq, S&P) posted their best year since 2013. Stocks were up broadly across most indexes. While a handful of sectors and market segments struggled to keep up, the number of stocks posting positive gains was healthy and encouraging.

- Growth wins big over Value: Growth stocks posted a 30% return in 2017 while Value delivered 12%. Since the financial crisis, Growth has led 7 of the 8 years. Historically speaking Value stocks outperform Growth stocks. Momentum may continue to propel Growth stocks past Value in the near term but history tells us that leadership will likely turn in the coming decade.

- International beats U.S.: Entering the year, “expert” consensus was that the U.S. dollar would surge during the Trump Presidency due to the new administration’s protectionist agenda. The opposite came to pass with the dollar falling by more than 9% over the year, providing a tailwind to Emerging Markets stocks (37.3%) and International Developed stocks (25.0%).

- Tech dominates in U.S. and China: Technology stocks continued their dominance in 2017 with a return of more than 40% in 2017. Tech now makes up over 21% of the S&P 500 and 31% of the MSCI China Index. Amazon, Facebook, Google, Apple, Netflix, Tencent, and Alibaba shined in 2017.

- Short-Term interest rates finally pay again: Since 2009, money market rates and bank CDs have effectively paid investors nothing to park their cash. In December, the Fed raised rates for the fifth time in a little over two years bringing cash rates to levels above 1%.

- Long-Term interest rates and Inflation remain stuck at low levels: Despite the Fed’s attempts to raise interest rates, longer-term rates have barely moved higher resulting in a flatter yield curve. In most Fed tightening periods we see a flatter yield curve. Many had hoped renewed economic growth would push inflation and yields higher to give the Fed room to navigate. So far that hasn’t happened, although recent economic data suggests there could be a risk to the upside on both inflation and rates.

The Get Rich Quick Crowd Returns

Like moths to a flame, people are drawn in by dazzling stories of their neighbors, friends, and colleagues making 10 times their money in the latest investment. In the 90s it was tech stocks and in the 2000s it was house flipping. 2008 seemed to shock the country. We haven’t heard from the overly confident speculators in a while, but they came back in 2017. Here’s what we mean:

- SNAP IPO: We covered the Snapchat (SNAP) IPO earlier this year. The mania on the first day or two showed a level of exuberance we hadn’t seen in a while.

- Bitcoin Mania: You can see our thoughts in last month’s Market Perspectives. We heard more than one holiday cocktail partier this season brag about their incredible returns in Bitcoin.

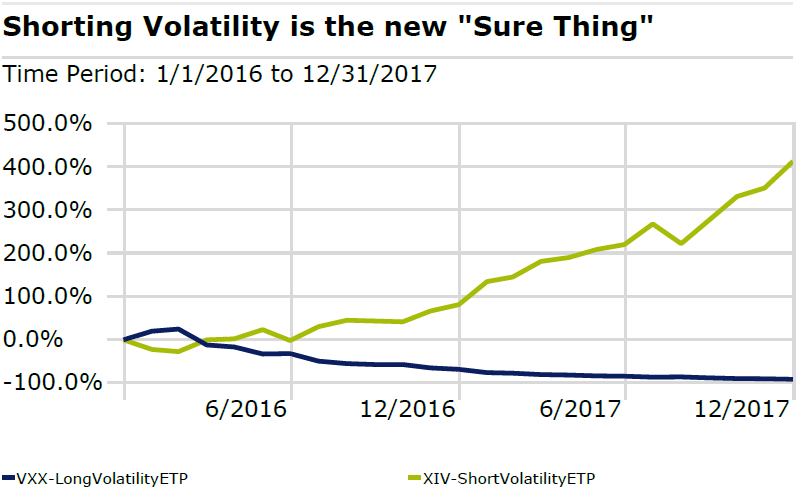

- Volatility Selling: Shorting volatility has been one of the most profitable investment strategies since the great recession. A story emerged about a man in Florida who quit his job managing a big box retail store because he had made more than $2 million shorting volatility. What does this mean? Each morning, the man would sell options (provide insurance) on the volatility index. If volatility stays low or goes down he collects the income but if it rises (and it can go up quickly and unexpectedly) he has to provide insurance. Gamblers (I’m not calling them investors) have flocked to buy short vol ETFs and to sell short the long vol ETFs.

We aren’t suggesting that the emergence of amateur investors hitting the lottery on long shots means the end is near. No one can correctly predict something like that, but we think this theme represents more clues that the excess of this cycle is building. A bad decision right now can lead to permanent loss of net worth. Investors should stick with their plan, participate in the upside, and ignore the guy at the country club or the holiday party that just made 20X shorting volatility.

By: Dustin Barr, CFA

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Quote of the Month

“Any bull market covers a multitude of sins, so there may be all sorts of problems with the current system that we won’t see until the bear market comes.”