Market Perspectives November 2024

Capital Markets

By: Wade Austin

Global markets experienced notable volatility during October amidst ongoing macroeconomic uncertainties, U.S. election jitters, and mixed earnings reports. Accordingly, investors turned to gold, a traditional safe-haven asset. Here’s a breakdown of the key themes:

Equity Markets:

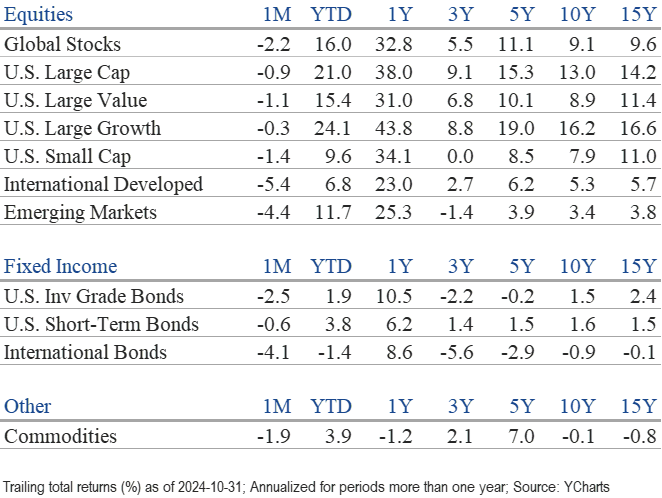

- U.S. stocks snapped a five-month winning streak. The S&P 500 declined 0.9% in October but maintained its strong YTD pace (+21.0%).

- The streak would have continued if not for a mega-cap tech selloff on the 31st. The S&P 500 dropped by 1.9%, primarily in reaction to Microsoft and Meta Platform’s forward guidance and elevated capital expenditure plans despite their record quarterly earnings and revenue.

- The combined revenue of the big four U.S. tech companies (Amazon, Apple, Google, and Microsoft) hit a record $1.6T over the last 12 months. That’s larger than the GDP of all but 15 countries. However, the difficulty of exceeding their lofty earnings and revenue expectations weighed on the broader market.

- After trailing value stocks for the past two and a half months, growth stocks outperformed in October. Large-cap stocks continued to outpace small caps.

- International developed and emerging market stocks dropped for the month, underperforming U.S. stocks. The U.S. economy (Q3 GDP of 2.8%) continued to grow faster than other regions worldwide.

Bond Markets:

- October was characterized by heightened volatility in the bond markets. After declining for five straight months, U.S. Treasury yields reversed trend and spiked. The 10-year yield soared 50 bps to 4.29%, and the 2-year Treasury yield backed up 54 bps to 4.19%.

- Many investors expected 10-year yields to fall further after the Fed announced a 50 bps cut to the federal funds rate on Sept. 18. However, resilient economic data and rising long-term inflation expectations drove yields in the opposite direction.

- As a result, the U.S. Bloomberg Aggregate Bond Index declined -2.5% in October, reducing its YTD return to 1.9%. All fixed income sectors declined last month. High-yield corporate bonds (-0.54%) led investment-grade bonds (-2.4%), while municipal bonds (-1.5%) outperformed Treasuries (-2.38%).

Key Takeaways:

- Gold was the big winner in October and has been for most of 2024, reaching $2,734 per troy ounce by month-end. Having reached 41 all-time highs and a YTD return of over 30%, no one predicted gold would outperform stocks amid a robust bull market.

- The real winner of last week’s election is the U.S. stock market. Our Chart of Month reveals that the S&P 500’s post-election performance is highly predicated, not on which party is victorious, but on the trend of the large-cap index leading up to the election. When in an uptrend on Election Day, the S&P 500 was higher both 3- and 6-months forward 84.6% of the time. During this election cycle, the S&P 500 had just celebrated its 2-year bull market birthday on Oct. 12.

- Historical data also suggests that U.S. stock markets tend to rally more after close elections. The premise is that economic/policy uncertainty and investor fear of the “other” party winning triggers risk-off positioning ahead of election day. We know investor anxiety was elevated this election as money market asset levels were at all-time highs. Further, many anticipated a contested result prompting put/call ratios to climb by the end of October.

- Presidential elections also happen to occur at the beginning of the best seasonal stretches of the calendar. Nov. to Jan. is the best 3-month period historically, while Nov. to Apr. is the strongest 6-month stretch. Investors are conditioned to expect year-end and Santa Claus rallies, but the data shows that stock market strength in election years typically continues through Inauguration Day. Also, on average, November is the best month of an election year.

- The first calendar year of a new President has been good for markets when a recession was avoided. As Strategas’ Dan Clifton joked, “it takes two years for a President to mess things up”. S&P 500 returns were exceptional during the past three occasions: +26.5% in 2009, +21.8% in 2017, and +28.7% in 2021.

- Last Wednesday was the best day after the election ever for the S&P 500 (+2.53%). The election results generated additional investor optimism due to the belief that:

- Despite both candidates being viewed as big spenders, Trump’s economic policies are considered much more pro-growth and pro-business.

- If Republicans retain the House as expected, a sweep enables them to enact pro-growth tax policies. The 2017 Tax Cuts and Jobs Act, scheduled to expire in 2025, will now be extended in some form. Harris’ corporate tax rate and capital gains tax hikes are off the table.

- On day 1, Trump pledged to dramatically slash regulations via Executive Orders. The market views the financial, industrial, and technology sectors and small caps as the biggest beneficiaries of deregulation.

- Consumer staples, utilities, and materials are the sectors expected to lag early in Trump’s second administration.

- While the deficit and $37T of accumulated government debt are “the elephant and the donkey in the room,” as John Silvia termed them, most investors are not too worried about the country’s fiscal situation in the near term.

- Investors’ chief stock market concerns will likely be too-hot sentiment and rising interest rates.

- The S&P 500’s 12-month forward P/E starting November was 21.4x, already 36% above its most recent 20-year average. Rich valuations can persist in the short term but will eventually become problematic.

- U.S. Treasury 10-year yields spiked as high as 4.47% the day after the election, their highest since early July. The market believes additional tariffs, as threatened by Trump, would lead to higher rates and bond yields, which, at some high level, would create a headwind for stock prices.

- Whether happy or discouraged by the election results, mixing politics and your portfolio is rarely a good idea. Using the extreme hypothetical example of investing $10,000 in 1953 in the S&P 500 and holding only under Republican Presidents, your portfolio would grow to $289,430 by Oct. 31. Conversely, holding only under Democrat Presidents, your investment would reach $675,312. However, by staying invested under both parties, your $10,000 investment would now be worth $19,545,555! As we approach year-end, make sure your portfolio is constructed to match your goals, regardless of political preferences.

Insights by John Silvia, Director of Economics

Treasury benchmark long-term bond yields have risen sharply over the past month. This rise indicates a change in market attitudes toward economic growth, inflation, and Fed policy. Investors’ expectations for the pace of economic growth and inflation have shifted upward, while expectations are lower for Fed easing in the year ahead.

- The latest Federal Reserve Bank of Atlanta forecasts Q4 growth at 2.3%. This remains a pace above potential and puts upward pressure on inflation, interest rates, and the dollar.

- Since Federal Reserve Chairman Powell’s presentation at Jackson Hole, expectations have become sensitive to labor market developments. The message at Jackson Hole was that labor market developments would take precedence over inflation in policy considerations.

- Labor markets have been stronger than expected in recent months, raising expectations for growth and inflation but lowering expectations for Fed easing.

- One indicator of a stronger labor market is the unemployment rate. Over recent months, the unemployment rate has remained near 4.1% -significantly below the Fed’s own expectation of a higher unemployment rate of 4.4% for the end of this year. Second, average hourly earnings rose at a 4.6% pace over the last three months compared to a year-over-year pace of 4.0%. This is above the 4.0% pace of the last twelve months.

- Economic growth readings continue to signal above-trend growth. Real personal consumption spending rose 2.6% during the last three months. During the third quarter, GDP grew 2.8%, while consumer spending contributed over 2% to that gain. In addition, all three sectors (consumer, business investment, and government) contributed to economic growth.

- Three signals provide corroboration to support the case for a stronger labor market and consumer spending.

- First, the 4-week average of initial jobless claims and continuing claims remains low and below the level of recent weeks.

- Second, the ISM-Services index is above breakeven and above the level of the second quarter.

- Third, non-defense, ex-aircraft, unfilled orders in September were below June and down year-over-year. This implies that the backlog of orders continues to decline and that supply chains are returning to neutral.

- On inflation, the Fed cites average hourly earnings as a signal of inflation pressures. This measure continues to disappoint. Over the last three months, earnings have been up 4.5% compared to 4.0% over the previous twelve months.

- Household inflation expectations remain above the Fed’s target 2% rate. The latest University of Michigan one-year inflation expectations are at 2.7%, while the five-year expectations for inflation are at 3.1%.

- For investors, the persistence of inflation indicates that the extent of Fed easing will be less than what the market is discounting after November.

- Our expectation for 2.4% economic growth has not changed significantly for all of 2024, which has provided a solid guidepost on the economy’s strength. Positive contributions to growth are broad-based and come from consumer spending, business investment, and government. Trade, however, has been a drag on growth as imports exceed exports.

- As for interest rates, expectations of stronger growth and 3% inflation have pushed up long-term rates. Meanwhile, expectations of a more limited extent of Fed easing have also lifted short-term rates. As a result, the yield curve has returned to a slightly positive slope—long rates higher than short rates—since the start of September.

- Expectations for growth, inflation, and interest rates continue to favor investors.

- Our three economic factors now support a positive tone for financial markets. Therefore, we will maintain our suspicion that the August/September weakness in financial markets was overdone relative to the economic fundamentals.

- Profits have been a big positive surprise for investors and have supported equity valuations. Pre-tax corporate profits bottomed out in the fourth quarter of 2022 and are up 13.6% year-over-year as of the second quarter of 2024. Strength in real final sales and improved productivity, which has lowered employment costs, have boosted profits above market expectations and, thereby, equity valuations.

- For the U.S. dollar, better economic data has led to an uptick in economic growth expectations and a downshift in the extent of Fed easing. Since late September, the dollar index, DXY, has risen steadily, which is in line with better economic prospects.

- On the global front, the initial disappointing China reopening has led to continued pessimism. Incidents of financial and commercial real estate weakness continue to moderate the economic outlook for China. Caution continues to be the watchword here as well.

- Expectations for economic growth in Europe and Japan continue to be below 1% for the year ahead. Consensus estimates for Canadian and U.K. growth have improved to 1% for this year.

- The central theme in our outlook remains. U.S. financial markets continue to adjust to the reality of better-than-trend economic growth, higher for longer interest rates (above the averages of the 2012-2019 period), and recently improved profit expectations.

Quote of the Month

“Keep your eye on one thing and one thing only: how much government is spending. Because that’s the true tax. If you’re not paying for it in the form of explicit taxes, you’re paying for it in the form of inflation or borrowing.”

— Milton Friedman, American Economist and Nobel Prize Winner

The information published herein is provided for informational purposes only, and does not constitute an offer, solicitation or recommendation to sell or an offer to buy securities, investment products or investment advisory services. All information, views, opinions and estimates are subject to change or correction without notice. Nothing contained herein constitutes financial, legal, tax, or other advice. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. These opinions may not fit to your financial status, risk and return preferences. Investment recommendations may change, and readers are urged to check with their investment advisors before making any investment decisions. Information provided is based on public information, by sources believed to be reliable but we cannot attest to its accuracy. Estimates of future performance are based on assumptions that may not be realized. Past performance is not necessarily indicative of future returns. The following indexes were used as proxies in the performance tables: Global Stocks = MSCI ACWI; U.S. Large Cap = S&P 500; U.S. Large Value = Russell 1000 Value; U.S. Large Growth = Russell 1000 Growth; U.S. Small Cap = Russell 2000; Int’l Dev Stocks = MSCI EAFE; Emerging Markets = MSCI EM; U.S. Inv Grade Bonds = Barclays U.S. Aggregate; U.S. High Yield Bonds = Barclays Corporate High Yield; Emerging Markets Debt = JPMorgan EMBI Global Diversified; Int’l Bonds = Barclays Global Treasury ex US; Cash = 3month T-Bill; Sector returns displayed in the chart represent S&P 500 sectors, while treasury benchmarks are from Barclays

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc., as of 3/31/2022. Asset class performance represented by annual total returns for the following indexes: S&P 500® Index (US Lg Cap), Russell 2000® Index (US Sm Cap), MSCI EAFE® Net of Taxes (Int’l Dev), MSCI Emerging Markets IndexSM (EM), MSCI US REIT Index (REITs), S&P GSCI® (Comm.), Bloomberg Barclays U.S. Treasury Inflation-Linked Bond Index (TIPS), Bloomberg Barclays U.S. Aggregate Bond Index (Core US Bonds), Bloomberg Barclays U.S. High Yield Bond Index (High Yield Bonds), Bloomberg Barclays Global Aggregate Ex-USD TR Index (Int’l Dev Bonds), Bloomberg Barclays Emerging Markets USD Bond TR Index (EM Bonds), FTSE U.S. 3-Month T-Bill Index (T-Bills). Past results are not an indication or guarantee of future performance. Returns assume reinvestment of dividends, interest, and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Chart of the Month: Strategas